Anne Arundel County Appraisal District

FY26 Property Tax Bill Information Anne Arundel County Government

Message from County Executive Pittman Dear Anne Arundel County Taxpayer, Since becoming County Executive, I’ve worked with my staff to redesign the budget process around you. This year, we maintained that transparent and open process by hosting 8 Budget Town Halls – one in each Council District, and another in Spanish.

https://www.aacounty.org/finance/tax-information/real-property-tax/fy26-property-tax-bill-information

Anne Arundel County Reassessment Areas

The Maryland Department of Information Technology (“DoIT”) offers translations of the content through Google Translate. Because Google Translate is an external website, DoIT does not control the quality or accuracy of translated content. All DoIT content is filtered through Google Translate which may result in unexpected and unpredictable degradation of portions of text, images and the general appearance on translated pages.

https://dat.maryland.gov/realproperty/pages/anne-arundel-county-reassessment-areas.aspx

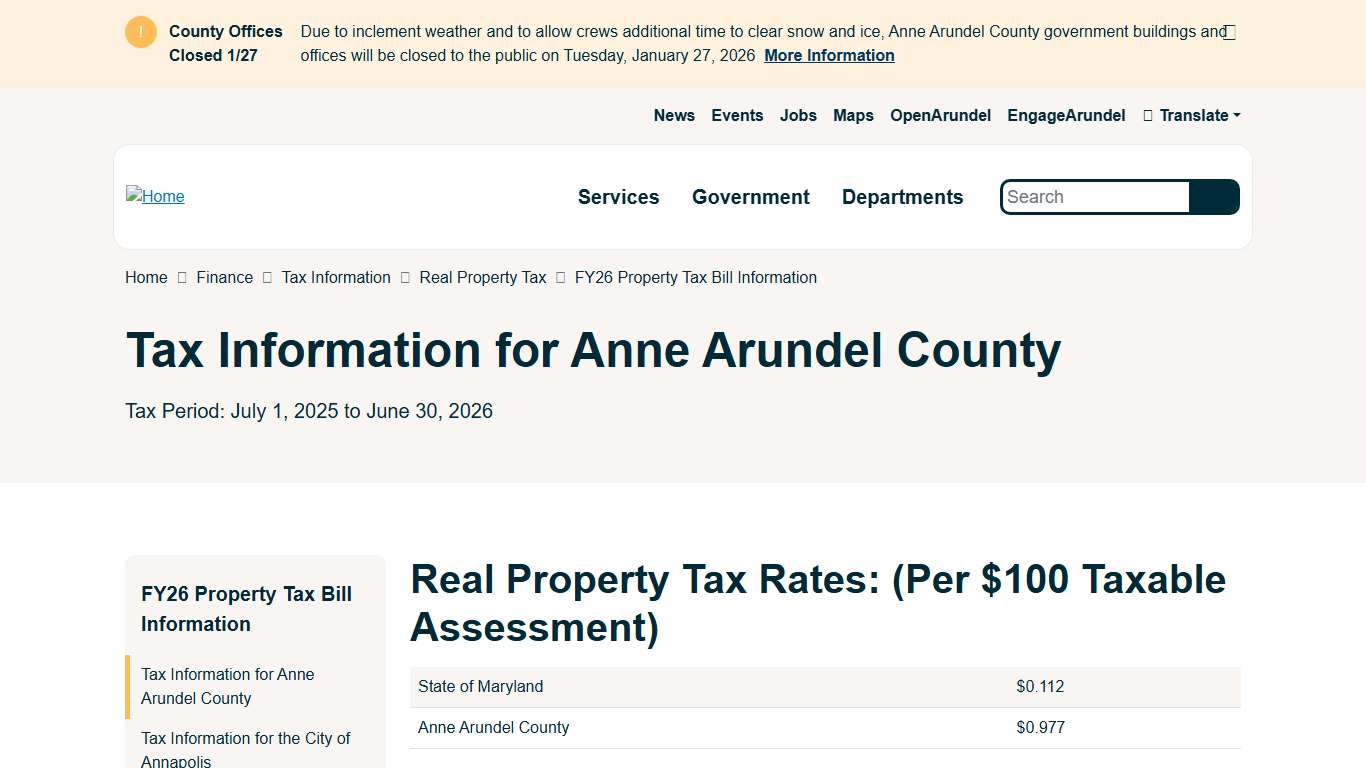

Tax Information for Anne Arundel County Anne Arundel County Government

Real Property Tax Rates: (Per $100 Taxable Assessment) Tax Bill Payments All checks should be made payable to “Anne Arundel County” and may be sent in the enclosed remittance envelope. Credit card and eCheck payments are accepted only through the County’s website: https://aacounty.munisselfservice.com/citizens/default.aspx (NOTE: There is a convenience fee assessed for a payment made with a credit card or for an eCheck payment.) When County of...

https://www.aacounty.org/finance/tax-information/real-property-tax/fy26-property-tax-bill-information/tax-information-anne

Real Estate Division Anne Arundel County Government

Main Functions - Property management, including leasing surplus office space for commercial and non-profit interests, leasing sites for telecommunications and water towers and monitoring property boundaries for encroachments. - Sell, transfer, and manage surplus real property in accordance with all policy and procedures as outlined in the County Code.

https://www.aacounty.org/central-services/real-estate

Property tax assessments to rise across Maryland in 2026 ...

Property tax assessments to rise across Maryland in 2026 by average of 12.7% ... I pay at close to the top rates in Anne Arundel county.

https://www.reddit.com/r/maryland/comments/1q0p9of/property_tax_assessments_to_rise_across_maryland/Real Property Tax Anne Arundel County Government

Real property taxes are due and payable without interest as of the first day of July in each taxable year. The deadline for real property taxes is September 30th, as interest and penalties begin to accrue on October 1st. Real property taxes on owner-occupied property are payable via semi-annual installments.

https://www.aacounty.org/finance/tax-information/real-property-tax

Maryland property values rose 12% in 2025 - The Baltimore Banner

Maryland property values are up on average by 12.7%, according to state tax officials, another year of double-digit growth that will lead to higher tax bills for many homeowners. But that growth is slower than during the last three years, where property values increased, on average, more than 20% over each assessment cycle.

https://www.thebanner.com/politics-power/local-government/maryland-property-value-assessment-LT6SODH3LRE5TBKXDFXWA3A7LI/

Maryland Property Tax Calculator - SmartAsset

Overview of Maryland Taxes Maryland’s effective property tax rate of 0.95% is slightly higher than the nationwide effective rate, which is 0.89%. However, because Maryland generally has high property values, Maryland homeowners pay more in annual property taxes than homeowners in most other states.

https://smartasset.com/taxes/maryland-property-tax-calculator

Anne Arundel County Property Tax Assessment Appeals (2021, 2022, 2023 Tax Cycle)

Anne Arundel County Property Tax Assessment Appeals (2021, 2022, 2023 Tax Cycle) January 15, 2021 Property owners in the southern half of Anne Arundel County, Maryland (see "Area 3" on map below) were mailed new property tax assessment notices on December 29, 2020.

https://www.councilbaradel.com/news/244-southern-anne-arundel-county-property-tax-reassessment-appeals

MD Association of Appraisers

09/20/2026. Types of Appraisal, Areas Served. RESIDENTIAL, ANNE ARUNDEL COUNTY AND OTHER JURISDICTIONS BY REQUEST. Appraiser Name, Company. CAROL J ADAMS.

https://www.mdappraisers.org/findagaappraiser.cfm

Anne Arundel County, Maryland Property Taxes - Ownwell

Anne Arundel County, Maryland Property Taxes Median Anne Arundel County effective property tax rate: 0.97%, slightly lower than the national median of 1.02%. Median Anne Arundel County home value: $376,600 Median annual Anne Arundel County tax bill: $3,553, $1,153 higher than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/maryland/anne-arundel-county

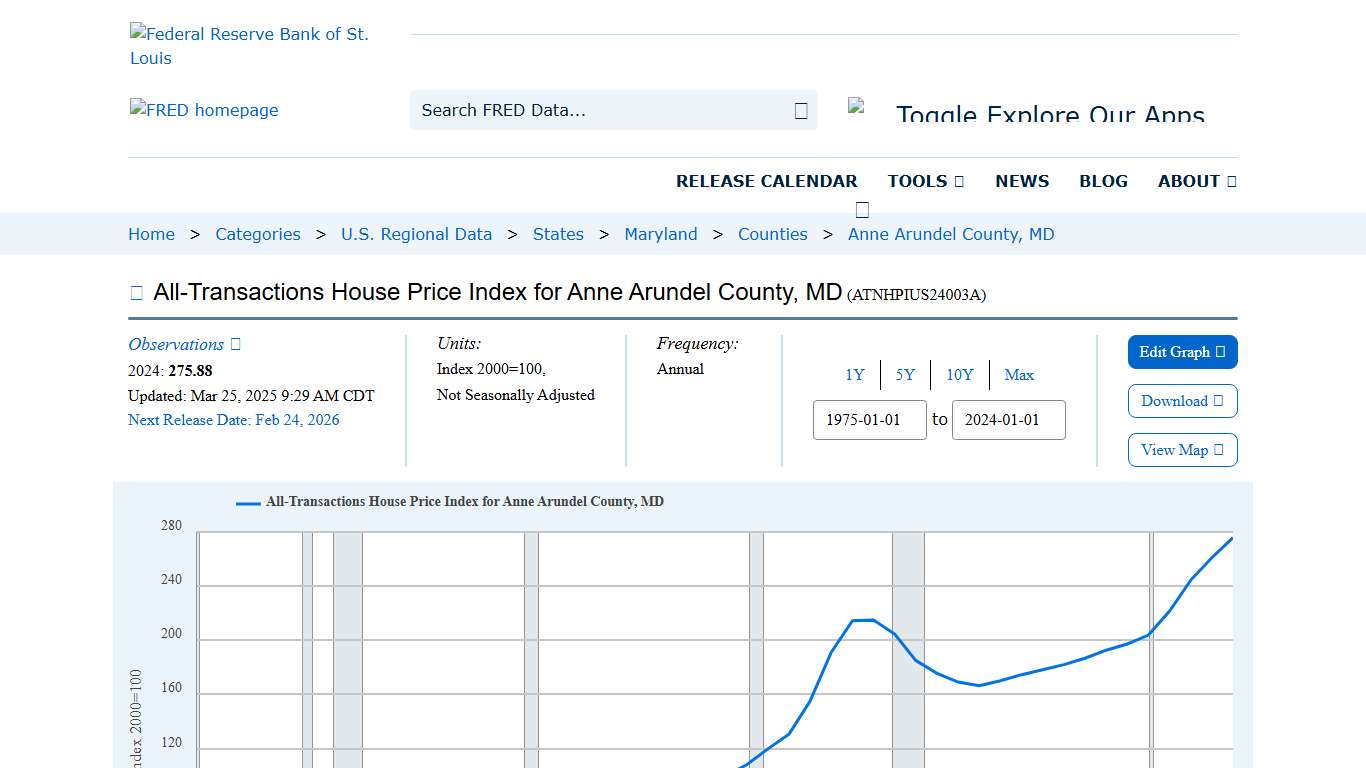

All-Transactions House Price Index for Anne Arundel County, MD (ATNHPIUS24003A) FRED St. Louis Fed

Units: Frequency: Chart Write a custom formula to transform one or more series or combine two or more series. You can begin by adding a series to combine with your existing series. Now create a custom formula to combine or transform the series.

https://fred.stlouisfed.org/series/ATNHPIUS24003A